By 1808Delaware

The Delaware City Council is actively considering a proposal to alter the city’s income tax rates. This significant change, if implemented, would mark the first adjustment in 13 years. A citizen-led task force has thoroughly examined the proposal, and a website is now open to the public for detailed information and comments.

A Look at the Proposal

A Dedicated and Long-Term Source of Funding

The proposed increase in funding is aimed at maintaining the high level of service that Delaware residents have come to expect. Unlike a temporary solution, the permanent nature of the proposed increase would enable the City to manage long-term debt required for vital projects.

Estimated Revenue and Allocation

An estimated $8 million in new revenue would be generated through the proposal. The funds would be allocated to various essential projects, such as:

- Parking garage construction

- Justice Center expansion

- New swimming pool complex

- Other community-identified high-priority services and facilities

Why Permanent Instead of Temporary?

A temporary solution might be suitable for a roads levy, but the current request encompasses more than just roads. It’s a comprehensive approach to address the City’s capital and operational needs. The permanent nature of the proposal underscores the need for a dedicated and lasting source of funding.

The Financial Review Task Force’s Involvement

A Citizen-Led Approach

The Financial Review Task Force, a citizen-led group of nine Delaware residents, conducted a rigorous review of the City’s financial standing. Meeting nearly two dozen times over a 10-month period, the task force conducted a high-level review of the City’s financial status and overall outlook.

Key Findings

According to the task force, Delaware offers a high level of services with one of the lowest tax rates compared to other Central Ohio communities. Their report warns that this relationship is unsustainable, projecting a negative general fund balance by 2026, growing worse in the subsequent years.

Capital Infrastructure Challenges

The task force revealed acute stress in maintaining capital infrastructure assets. A total of $3 million in planned projects were cut or deferred in 2022 and 2023 to minimize impacts on the operating budget. However, the capital budget deficit could grow to nearly $19 million by 2027, making the proposed changes necessary to meet community expectations.

Public Engagement and Council Approval

Residents are encouraged to read about the specifics of the proposal and submit a comment here by August 23. The site also has additional information and resources.

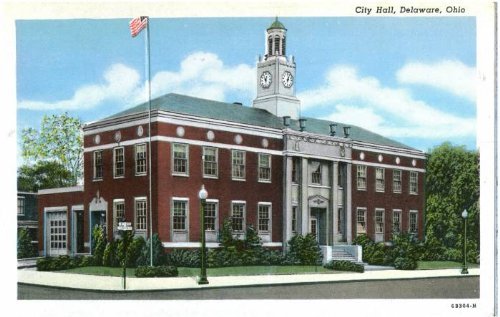

Council approval is required to place the issue on the ballot. Legislation will be discussed during a series of public meetings at City Hall, which will include opportunities for public comment.

In a growing city like Delaware, ensuring that residents continue to receive high-quality services without overburdening the budget is a delicate balancing act. This proposed income tax adjustment seeks to establish a permanent funding source to support various critical projects and maintain the expected level of service. The City Council, with the involvement of the citizen-led task force, has laid out a transparent and thoughtfully considered plan, now open to public scrutiny and feedback.

Image by Steve Buissinne from Pixabay