By 1808Delaware

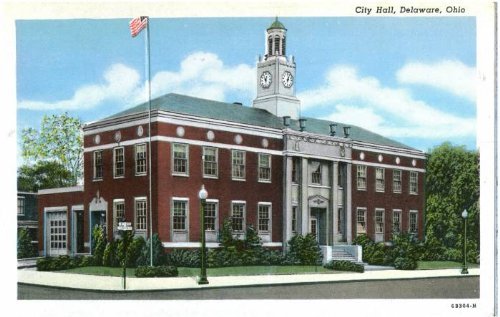

Delaware City Council will convene this evening, August 26 at 7:00 PM in City Council Chambers, located at 1 South Sandusky Street. Among several matters on the agenda, the Council will consider Ordinance No. 24-71, which proposes a Community Reinvestment Area (CRA) Agreement and School Compensation Agreement involving Pittsburgh Flex, LLC, the City of Delaware, Delaware City Schools, and the Delaware Area Career Center. The meeting will be streamed live on the City of Delaware’s website under the “Events” section at www.delawareohio.net.

Overview of Ordinance No. 24-71

Ordinance No. 24-71 seeks Council approval for a CRA Agreement that would grant Pittsburgh Flex, LLC a 100% tax abatement over 15 years for the construction of a new building on Pittsburgh Drive. The proposed development, located on a six-acre parcel, is expected to result in a multi- or single-tenant speculative building totaling 55,000 square feet.

Key Aspects of the Proposal:

- CRA Tax Abatement: The ordinance proposes a 15-year, 100% tax abatement for Pittsburgh Flex, LLC for their new construction on Pittsburgh Drive. The development is projected to cost approximately $7,000,000.

- School Compensation Agreement: To address the potential impact of the tax abatement on local education funding, Pittsburgh Flex, LLC has agreed to a School Compensation Agreement. This agreement includes annual PILOT (Payment in Lieu of Tax) payments totaling $9,360 to be distributed between Delaware City Schools and the Delaware Area Career Center. Currently, the property contributes $822 annually in property taxes to these institutions.

- Employment and Payroll Projections: The agreement includes a commitment from Pittsburgh Flex, LLC to create at least 30 new full-time jobs with an annual payroll of $1,500,000. This increase in payroll is anticipated to generate approximately $27,750 in new income tax revenue for the city, based on the current income tax rate of 1.85%.

Considerations and Potential Impact

The proposed development is intended to enhance economic activity in Delaware, with the CRA Agreement being one of several tools used to attract investment. The School Compensation Agreement aims to mitigate the potential loss in property tax revenue by ensuring that local schools and the career center receive a higher annual payment than what is currently generated by the property.

The creation of new jobs and the increase in payroll is expected to contribute to the city’s income tax revenue. However, the full impact of the tax abatement and development on the community and local economy will likely be a key point of discussion during the meeting.

Broader Agenda

In addition to Ordinance No. 24-71, the Delaware City Council meeting will address several other matters that are on the agenda. Residents and interested parties are encouraged to attend or watch the live stream to stay informed on the discussions and decisions that will affect the community. The full agenda and packet can be found here.

Image by Borko Manigoda from Pixabay